House Rent Allowance under Section 10(13a): Here’s What You Need to Know

In India, most workers are eligible to receive House Rent Allowance under Section 10(13a) of the Income Tax Act (ITA).

This provision of the ITA is one of the most crucial components of an employee. Here, these deductions are liable for full/partial taxation under Section 10(13a) of the ITA. Basically, the House Rent Allowance is an allowance that an employee receives from the employer to cover the cost of living.

In this article, you will learn about Section 10(13a) of the Income Tax Act and the house rent allowance that is available under the act. Firstly, the article will discuss the major features and benefits of Section 10(13a). Furthermore, you will learn the major aspects of the House Rent Allowance and its taxable properties. Finally, you can learn how to calculate and claim your HRA. Hence, to learn more, read on to the end of the article.

What Is Section 10(13a) of the Income Tax Act?

Section 10(13a) of the Income Tax Act 1961 is an important provision for salaried individuals in India. As per this provision, salaried individuals are able to receive tax deductions on House Rent Allowance (HRA) that they receive from their employers. However, these deductions and benefits are available under certain conditions. Generally, the HRA is a salary component of employees that employers provide to meet the former’s rental housing expenses.

How much an employee receives in the HRA depends upon the following factors:

- Employee Salary

- The rent that the employee pays

- The employer’s consent

- Employee Residence

- The place where the company or the employer is located

Basically, different sections of the Income Tax Act contain different help options for salaried individuals, professionals, and the self-employed. The focus is to ensure that their rent expenditures are lower and more desirable. Furthermore, there are also various minor components in the salaries of private and public sector employees. Hence, an employee can only derive or fix an HRA through a special agreement with the employer.

Major Features of Section 10(13a) of the Income Tax Act

If you do not receive HRA or if you fail to claim tax exemption under Section 10(13a), then you are missing out on potential tax savings. The following are some of the key features of Section 10(13a) of the Income Tax Act:

1. Exemption Conditions

You already know that you can get tax exemptions on house rent allowance under Section 10(13a) of the ITA. However, if you want to claim HRA, you will have to fulfill certain conditions. Here are the conditions:

- You will need to be a salaried individual who receives HRA from the employer.

- You must incur expenses for the rent for residential accommodation that you occupy yourself.

- The HRA that you receive, you must utilize it to pay your rent for your accommodation.

2. Exemption Calculation

To claim a tax exemption, you will first need to calculate the amount that you want to be exempted. Here are the things that you need to consider for tax exemption:

- The Actual HRA that the employer offers.

- The difference between the rent amount and your salary’s 10% amount.

- If you are living in a metro city, then it is 50% of your salary. However, if you live in a non-metro city, the amount is 40%.

3. Submission of Rent Receipts

To get an HRA tax exemption, you will also need to submit your rent receipts. Apart from that, you will also need to show other documentary evidence that supports your rent payments. This will help you to claim your HRA tax exemption faster as you fill out your income tax returns.

House Rent Allowance under Section 10(13a): What Is it?

The House Rent Allowance is a sub-component of an employee’s salary that enables full or partial tax deductions. Here, the Section 10(13a) of the Income Tax Act supports the deduction process. However, how many deductions you are eligible for depends on a variety of factors, which are explained in previous sections.

Basically, the HRA is an allowance that you receive from your employer. This helps you cover the cost of your living on rent. Such tax exemptions not only help individuals to save their money but also promote renting homes.

However, the house rent allowance is not entirely applicable for taxation, even though it is a part of your salary. Here, Section 10(13a) of the ITA allows tax exemption of a portion of your HRA. Furthermore, these exemptions are subject to certain provisions.

Until you calculate your taxable income, you can deduct your HRA exemption sum from your overall income. This further helps you save money on your tax payments. However, you will also need to bear in mind that if you live in your home and do not pay rent, then the HRA that you collect from your employer is completely taxable.

The tax exemption option under Section 10(13a) is available to salaried individuals only. However, these salaried individuals need to have an HRA portion of their pay structure./ Furthermore, they also need to live in rental housing. On the other hand, this tax exemption or the allowance itself is not available to self-employed personnel.

HRA for the Self-Employed

The tax exemption for house rent allowance under Section 10(13a) is not available to you if you are self-employed. However, you will be able to avail of tax deductions towards the rented accommodation under Section 80GG of the Income Tax Act 1961. Furthermore, you can use this Section to claim HRA tax exemption if you are a salaried employee (provided you do not receive any HRA).

HRA for Salaried Individuals

It is already obvious now that under Section 10(13a) of the Income Tax Act 1961, salaried individuals are eligible for HRA exemptions.

This rule is available in the 2a subpart of the act. Since the house rent allowance is an important aspect of an individual’s salary, the individual has the right to claim tax deductions as per the rules of the company.

On the other hand, it is also important for the company to create policies accordingly and ensure that the employee gets access to the tax exemptions under this section.

House Rent Allowance under Section 10(13a): Types of Expenses

The HRA tax exemption is available for certain types of expenses. The following are the major types of expenses that are available for house rent allowance under Section 10(13a) of the Income Tax Act 1961:

- Rent Paid: This is the actual amount of rent that the taxpayer pays for the residential accommodation. However, the taxpayer must live in this accommodation.

- The HRA also applies to any brokerage or commission that you pay to the real estate agent or a broker, which is essential to secure rented accommodation.

- It also consists of other maintenance charges that are essential for renting properties. These expenses also include society maintenance fees or rented accommodation.

- Utility payments for rented accommodation – electricity, gas bills, water, etc.

- HRA also includes the costs that you have to incur for the preparation and registration of the lease agreement of the property under rent.

- Municipal tax payments or property taxes are also applicable to the house rent allowance.

- The house rent allowance is also applicable for stamp duties that you pay for the rental agreement or lease deed.

Here, you can see that only those expenses that have a direct relation with the taxpayer’s rental accommodation are eligible for tax exemption for house rent allowance under Section 10(13a) of the Income Tax Act 1961.

Is the House Rent Allowance under Section 10(13a) Taxable?

Since the house rent allowance is a part of the income from your salary, it is regarded as taxable income. However, if you stay in rent, you have the chance to claim tax exemption either fully or partially under Section 10(13a) of the ITA.

This tax exemption is the HRA exemption that is being discussed in the article. However, if you do not live in a rented property and you still get this allowance, then it is fully taxable. Here, you will not get any tax exemptions.

How Can Taxpayers Benefit for the Section 10(13a) of the ITA?

Tax exemption on any part of the salary is a great benefit for the taxpayer. Hence, such exemptions on the HRA are pretty important. The following are some of the major benefits taxpayers receive for house rent allowance under Section 10(13a) of the ITA:

1. Tax Savings

If you claim a tax exemption on house rent allowance under Section 10(13a), you can reduce your taxable income significantly. This will result in you having lower tax liability.

2. Financial Relief

You can also avail yourself of financial relief if you offset a portion of your rental expenses and choose tax exemption on your house rent allowances.

3. Home Rental Incentives

Section 10(13a) of the ITA can also offer you incentives that will allow you to choose rental accommodations in urban areas where rents are usually high. Hence, getting a tax exemption here can be advantageous for you.

4. Simple Tax Payments

The provision under Section 10(13a) actually offers you a strong framework to give HRA exemption. Furthermore, the provision simplifies the tax compliance for both salaried employees and other taxpayers.

How Can You Claim HRA Exemption?

Claiming an HRA exemption can be hugely beneficial for you. However, there are certain conditions that you need to meet. These are:

- You have to live on a rent.

- The house rent allowance (HRA) that you receive is a part of your salary.

- You need to submit rent receipts and other proofs that show that you really live on a rent.

Based on this information, you will need to calculate your house rent allowance. This calculation will also depend upon a variety of factors, including rent paid, salary, allowance amount, location, etc.

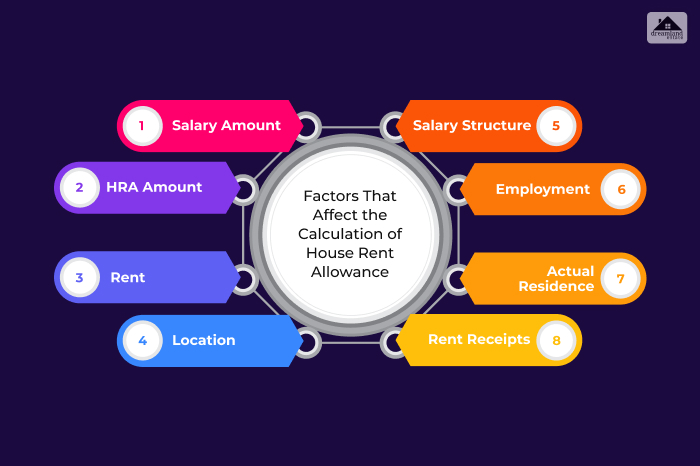

Factors That Affect the Calculation of House Rent Allowance

There are a variety of factors that influence HRA’s calculation under Section 10(13a) of the ITA. Hence, it is important to learn about them briefly and be aware of them. The following are the factors you need to consider:

Salary Amount

Since HRA is a percentage of the salary, a higher salary necessarily leads to a higher HRA.

HRA Amount

The actual HRA that you receive from your salary is a major aspect to consider as you calculate the tax exemption.

Rent

The rent amount is important to find the tax exemption in relation to the salary.

Location

The location of your rented residence also matters when you calculate the HRA exemption. For example, if you live in a metro city, you will have a higher tax exemption.

Salary Structure

The salary structure, including the basic and DA, is essential to calculate the amount of HRA tax exemption.

Employment

The nature of your employment is also an important aspect to consider. Whether you work in the private sector or the public sector, it will help determine tax exemptions.

Actual Residence

Your residence, that is, whether you live on a rent or you own the property, determines your tax exemption. If you own the property, you will have to pay the full tax amount.

Rent Receipts

While you are claiming tax exemptions, you will also need to prove that you live on a rent. Hence, you have to show the necessary documents.

How to Calculate Your Exemption on House Rent Allowance?

To claim an HRA exemption, you will have to choose the lowest of the following amounts:

- The amount you receive is the actual house rent allowance.

- 50% of your salary (basic + DA) for individuals who live in metro cities.

- 40% of your salary (basic + DA) for individuals who live in non-metro cities.

- The difference between your actual rent paid and 10% of your salary (basic + DA).

Wrapping Up

Hope this article was helpful for you to get a good understanding of the tax exemption for house rent allowance under Section 10(13a) of the ITA. Hence, if you are about to claim tax exemptions, make sure you are aware of the factors that are important to calculate the HRA exemption amount.

Do you have more information to add? Consider using the comments section to share your input.

Read Also:

Leave A Reply