A Comprehensive Guide To Home Loan Principal & Other Fundamentals For Beginners

The home loan principle is a fundamental concept that every new homeowner needs to understand. However, there is a lack of clarity as to the nature of this aspect. As a result, I am bringing you an extensive guide to loan principles and fundamentals that you must know before making any investments.

What Is A Home Loan?

Buying a home is on everyone’s cards. However, it is easier said than done. Buying a home is an expensive affair nowadays, given the dearth of habitable land and the growing population. As a result, homeowners are turning towards home loans.

A home loan can be defined as money borrowed by an individual to build a home. Housing finance companies and banks usually give out home loans. Housing loans can be categorized according to their variation and purpose. Here are some of the most common housing loan variants that you need to know about:

Home Buying Loans: This is the most common variant of a housing loan. These loans are mainly for buying apartments and flats.

Home Construction Loans: This variant is available to individuals who want to construct their homes. You can avail of this loan if you already own a plot.

Home Renovation Loan: People who already own a house but want to renovate can avail of this loan.

Home Extension Loan: This allows individuals with financial aid to extend their residence to accommodate more people. It is one of the most uncommon variants of housing loans in India.

Plot Loans: People who want to buy plots but do not have the money can take plot loans from banks to buy a plot. Some banks offer specialized packages where a person can avail of a plot as well as a home construction loan at the same time.

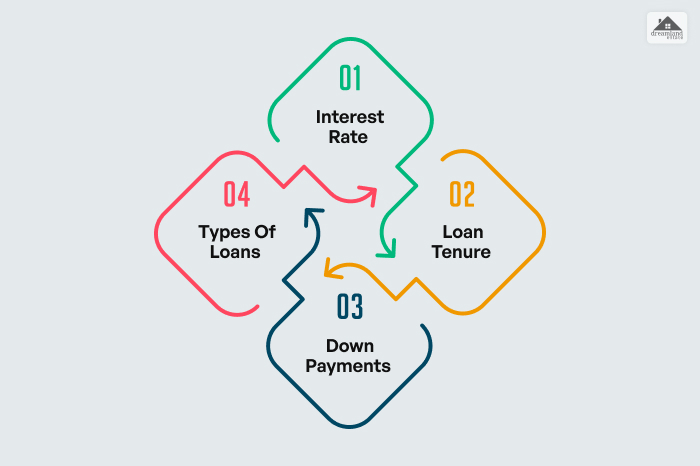

Fundamentals Of Home Loan

A home loan is a gamut of complex systems working in synchronization. As a result, you must have a clear understanding of each of the cogs in this grand machinery. Otherwise, you will end up making an uninformed decision.

A home loan process consists of several fundamentals, such as the interest rate, loan tenure, down payment, home loan principal, and types. Each factor is as important as the next. As a result, it is essential to understand all the ancillary fundamentals before we start delving deep into the conversation about home loan principles.

Here are some of the basic fundamentals of home loans that you need to know about:

Interest Rate

Interest rate is the rate of interest charged by the banks for giving out loans. Users have to pay interest alongside the principal. The interest rate of a home loan is usually based on factors like the repo rate and the government mandate.

The interest rate differs between financial intuitions. In fact, it can even vary from one person to another. Interest rates come in various formats, such as floating, fixed, and combination loans. Each of these has their own advantages and disadvantages.

In general cases, borrowers who have good credit scores and fulfill all the conditions set forth by the bank are charged a lower interest rate than others. Therefore, keep a good CIBIL score and check your finances to get a good deal.

Loan Tenure

The next important factor that you need to know about is the loan tenure. As soon as you take a loan, the bank assigns you a specific time period. A borrower is expected to finish paying off the loan before the tenure ends.

Loan tenures are usually decided on factors like the borrower’s age, CIBIL score, profession, the kind of loan you are taking, etc. Therefore, loan tenure is an essential aspect of the whole deal.

Loan tenure and interest rates are co-dependent in a way. Longer tenure is equivalent to a lower interest rate and vice versa. Therefore, tenure is an essential aspect of the home loan process.

Down Payments

Downpayments of home loans are the initial money that every individual needs to pay upfront. This down payment is usually made to a bank or an NBFC firm like the Bajaj Finserv.

Downpayment percentages vary from organization to organization. It is usually a percentage of the principal amount. In a general scenario, the ideal down payment is around 20% of the principal amount.

In fact, a mandate shared by RBI claims that a lender can only lend 80% of the total amount. Therefore, you need to pay at least 80% of the total amount. Thus, chalk out a plan and create a home budget in order to save up some money for the down payment.

Types Of Loans

One of the most fundamental aspects of home loans is that they come in various shapes and sizes. Hence, it is essential for borrowers to know the different home loan variants that exist.

As I have already pointed out, home loans can be broadly categorized according to their purposes. In fact, they can also be differentiated according to the interest rates. Some loans have floating interest rates. Subsequently, some variants have fixed interest rates.

As a borrower, you need to be familiar with all the variants of home loans available so that you can make an informed choice rather than a random one.

Regulatory Markers

Housing loans are complex. The adverts might show that they are accessible. The truth is far from that.

Hence, new borrowers should have some idea about the nuances of these regulatory markers. Contrarily, knowing these markers is not an easy task. As a result, many people are making decisions blindly. This is a big no and can be detrimental to you financially.

Here are some of the regulatory markers that you need to know before moving ahead. Let us dive right in!

CIBIL Score

A CIBIL score is a three-digit numerical value summarising your credit score. It is a very important aspect of the home loan process. As per norms, an ideal credit score for a person should range between 300 and 900.

Your CIBIL score is made up of several factors, such as credit history, previous loan repayment, etc. This is maintained by a centralized system powered by details of your PAN card. As a result, all your financial transactions are recorded in your CIBIL score.

One way to improve the overall CIBIL is by completing your payments on time. A low CIBIL score will stop you from taking any sort of loan. Therefore, you need to be mindful of the implications of late repayment.

LTV Ratio

LTV, or loan-to-value ratio, is one of the most critical factors that can make or break a deal. The ratio shows the amount of property that you can loan.

The LTV ratio is a driving factor behind deciding the optimal downpayment for your property. For example, you are buying a property worth one crore. The lender you approached is offering you an LTV ratio of 75%. This means that the lender is willing to loan out 75 lakhs to you. Hence, you have to pay 25 lakhs as a down payment before availing the benefits of a housing loan.

RERA Compliance

RERA, or Real Estate Development and Regulatory Act, was passed by the Indian government in 2016. The act primarily aims to safeguard homeowners from exploitation and protect their rights. Here are some of the critical points of the RERA compliance:

- The act maintains accountability to allotters and safeguards their interest.

- The act increases clarity that can help homeowners to point out a safe deal. It tries to uphold justice and crack down on the illegitimate activities of fraudsters.

- The act establishes a sense of professionalism and uniformity across India.

- It aims to build a proper bridge between the service providers and the clients.

- Finally, it aims to impose equal responsibilities and duties on builders, investors, financiers, etc.

NPA Declaration

Finally, you need to know about the NPA declaration. As a lender, it is your onus to pay all your EMIs on time. Otherwise, you can seriously damage your CIBIL score.

If a payee fails to pay the EMI for more than three months, the respective loan becomes a Non-Performing Asset. This is a colossal blunder that you must avoid at all costs. It can seriously damage your credit score and prevent you from taking out any more loans.

As a borrower, you are liable to declare all the NPAs you have in your name. Otherwise, you are withholding information and endangering the company.

What Is Loan Principal

With the basics out of the way, you are ready to understand the nuances of home loan principal. The word is usually used to denote the primary amount borrowed by a person for their home loan.

The concept of loan principal is not exclusive to home loans. In fact, the idea of loan principal permeates to other variants of loans as well. In the case of home loans, the principal comprises additional fees, extra charges, and the borrowed amount.

The principal loan amount is then broken up into smaller parts called EMI or easy monthly installments over a span of twenty or thirty years.

The principal amount is a fluid number. As a payee keeps paying, the overall amount keeps reducing. Therefore, the home loan principal is the amount of money you owe to the bank or the financial institution. As a borrower, you should definitely keep track of the principal in order to track the progression of loan repayment.

How Home Loan Principal Function

Home loan principal functions similarly to interest. Yet, there are some differences that must be noted. For example, you have taken a loan of 10,000 for 12 months. Subsequently, you have made a downpayment of 2,000. As a result, your home loan principal is now (10,000-2,000) 8,000. On the other hand, the bank charges a total interest rate of 4%

Going by the former numerical, the first month’s principal amount is 8,000 x 4%/12. This principal reduces with every month till the bank reaches 0.

Home Loan Principal is one of the most basic and essential aspects of the whole process of a home loan. It is a clear marker of how much money you owe to a financial institution.

How To Pay Back The Loan Principal Quickly

One of the biggest questions that people are concerned about is the repayability of home loan principal. Several new homeowners have raised concerns about paying their home loans quickly.

Is it even possible? Well, the answer is yes. Yes, you can pay your home loan principal earlier than the quoted tenure. No, it will not affect your CIBIL score. Instead, this might bump up your score.

Here are some ways in which you can reduce your principal quicker.

Save Monthly Payments

It might sound crazy, but I would suggest you pay more than the decided EMI amount. This will help you save money in the long run as it will help you foreclose the deal. This will help you save up money on interest and improve your CIBIL Score.

Reduce The Tenure

By making additional payments, you are not just clearing your principal. You are also reducing the overall tenure of your loan. This is a great practice that can ease the grueling tenure that might last decades. As a result, always pay more than what the bank asks. This has some really excellent benefits and can help you reduce your home loan principal and clear the debt off your name.

The Closing Thought

In summation, that is all there is to understanding home loan principal and other basics of the home loan process. Buying your own home is a Herculean task that needs a careful approach. Therefore, please do not make any decision before reading about it. And keep following our page for more such content.

Read Also:

Leave A Reply