How To Save Money For Your Home Budget

Buying a house is not the easiest or the cheapest decision you might make. It is one of the biggest and most important financial decisions of your career. Therefore, you need to have a proper home budget that can help you take the financial burden head-on. Read more to know how.

How To Save Money For Home Budget?

Saving money is an art. It is something only some can be good at. However, knowing how to save money is something other than something that you need a degree. Employing some basic saving techniques can actually save your skin.

But the catch is that you need to know about these techniques in order to employ them. Hence, this article is all about that. In the remainder of this article, I will be talking about ways in which you can save up money for your home budget.

One thing that you need to know before we embark on this journey is saving money tips are not a one-size-fits-all situation. This means that you need to know your situation and act accordingly. With that note, let us dive right in.

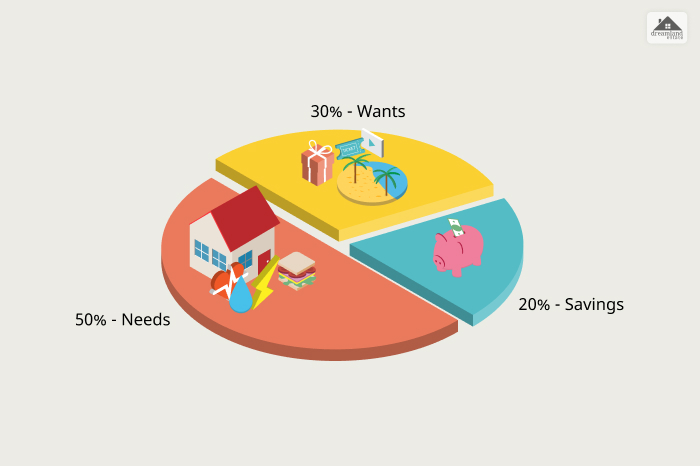

The 50/30/20 Rule

Saving is the most basic human skill that every human being needs to work on. Regardless of your current earnings, you need to save up money. Otherwise, you will have to face the music.

One of the most tried and tested variants of saving is the 50/30/20 rule. The United States Senator Elizabeth Warren initially popularized this variant of saving. She extensively talked about the importance of saving money in her bestseller book called, “All Your Worth: The Ultimate Lifetime Money Plan.”

The rule is straightforward: break your total monthly bearing into three distinct categories according to its usage. This breakup would be at a ratio of 50:30:20. This will help you to compartmentalize expenses and keep a steady flow of funds.

50% Needs

The first piece of the puzzle is the lion’s share. As per the norm, keep 50% of your total salary aside for needs. Needs usually refer to things that you need for survival. These can also be termed as basic expenses a person needs in order to survive.

Some of the most potent examples of needs include tax, electricity, water, internet, transportation, food, debts, utilities, car payments (fuel or EMI), etc. In fact, setting an upper cap helps you compartmentalize. Subsequently, it also works like a marker that you need to follow in order to keep a check on your finances.

Try to stay within 50% of your monthly salary to tend to your basic needs. If you do exceed, remember that you need to readjust your living style. Otherwise, you will need more money to go around.

30% Wants

The next category on our list is the wants section. Wants are simple. They are more fundamental than basic expenses. However, they are still very much part of your financial plans.

Wants are optional expenses that you need to make in order to lead a prosperous life. I mean, what is the point of making a home budget that does not leave room for some ‘fun.’

Anything that goes in the wants bucket is not earth-shattering in nature. Therefore, you can be a little prim and proper about it. Take my opinion, and save up as much as you can of the 30% want bucket. This will help you get closer to your preferred home budget faster.

20% Savings

The final section of the 50/30/20 Rule is the pure saving. This 20% is a small contribution. However, consistently saving up 30% of your salary can actually help you to collect a respectable corpus of funds for future usage.

A general rule of thumb that you need to follow while saving is that you must have buffer funds for at least three months. In other words, you should have enough funds to sustain yourself for at least three months if an emergency arises.

- Some of the government-sponsored saving programs include:

- I am creating a small corpus of emergency funds for rainy days.

- You can open a mutual fund after a specific period of time.

- I am investing in stocks.

Why You Must Save

Saving is a noble idea. However, human beings need to improve at saving up money. A study conducted back in 2023 found that only 3.7% of the population actually saved money. If the list includes you, then you should also start saving in order to get closer to the home budget you need for your new house.

There is no easy solution to this low-saving drive of individuals. However, the 50/30/20 rule can be a savior. In fact, statistics show that people who employed this technique managed to save up a handsome sum in just a few years.

If you need some more convincing, here are some of the most important reasons why you should save up money in order to invest in a home.

Ease of Use

The foremost reason for saving up money is the overall ease of use of your finances. Any saving format like the 50/3/20 or Pomodoro technique ensures that your expenses are structured.

This framework acts as a set pattern for your expenses. This can help you to structure and keep your costs in check. If you follow a set pattern, you do not have to sit with your calculators more often than not.

This would enable you to be more financially confident. Even people who are luddite with numbers can actually turn into master savers if they are aware of the breakup of their financial numbers. Over time, they will save enough money to inch towards their dream home budget.

Money Management

Having a proper plan for saving up for your home budget is not a self-contained skill. Buying a house requires careful planning and financial stability. Therefore, buying a house on a budget or having a proper home budget can teach you a lot about money management.

Money management goes beyond saving. It includes points like investment, saving, etc. Therefore, saving up for a house will actually help you broaden your skills beyond the required domain.

Money management is an essential skill that everyone needs to work on. It is one of the basic skills that people in their 20s should learn and people in their 30s should master.

Prioritization Of Expenses

Having a home budget and following that budget is an essential thing to learn. It will teach you how to save up money and how to prioritize your spending. Once you master the skill, you will automatically ask yourself questions before making any form of expenses.

Follow the budget for a long enough time, and you will actually learn how to prioritize your vital expenses over the unnecessary ones. This will not only help you save up money but will also develop a sense of financial maturity that is hard to gain. As a result, it will teach you a life skill that will enable you to formulate assets like another house, a car, etc.

Savings Goals

Saving goals is a real thing that every earner needs to know about. By consistently allocating 20% of your funds, you can actually set up a personal goal for yourself and your finances. This can also come in handy if you hit a rough patch.

Even though you might be saving up to buy a house, you need to understand that life is unpredictable and fleeting. In other words, you can never really factor in what might happen. Hence, having some funds for rainy days could help you deal with different problems.

Therefore, set up a home budget, but keep an open mind that you might need it for rainy days.

Financial Security

Financial security is an important aspect that every human being needs to have by the age of 35. Therefore, every human being must have a plan to reach that security. You should not employ these methods outside of saving for a house.

The 50/30/20 method is an excellent method for saving up for big decisions like cars, houses, etc. Therefore, continue if you are done saving your home budget. Continue this habit for a prosperous life and future.

The aforementioned methods will help you reach financial stability and fulfill your financial objectives. In fact, it will also help you guys become financially confident.

How Should You Employ The 50/30/20 Budget Rule?

I do not need to spend an extra minute convincing you all as to why it is essential to have a plan for your home budget. As a result, let me shift my pace and discuss ways that can help you save up money.

Here are some of the ways that can help you save money for your home budget. Here we go!

Keep A Track Of Your Expenses

The foremost thing that you need to do is to keep a clear track of your expenses. Remember that it takes 21 days to inculcate a habit. Therefore, you need to keep track for a month or two, and things will fall into place eventually. The first few months will help you to establish a base. You can move ahead from there.

Understand The Income

One of the most significant points for creating a proper home budget or saving plan is to understand your income effectively. You cannot chalk out a plan if you have no idea how to proceed with the plan. Have a clear idea about your expenses, and you will be able to understand the direction you need to take. Otherwise, you are bound to take the wrong route.

The Critical Cost Identification

It is inevitable that you will develop a sense of cost identification as you continue formulating your plan for building a full-proof home budget. In fact, being good at identifying critical costs will also help you compartmentalize your finances more effectively and efficiently. It also helps you to improve your financial skills.

Automate

2024 is all about automation. Everything is getting automated. In fact, there are ways in which you can even automate your savings. This is the best way of saving up money for a house. It brings a sense of consistency. Link your bank account to an automated savings service in order to save money without ease. The application will debit the money and store it in an account you can access as a form of savings. Users report that these applications make the saving process more streamlined and devoid of burden and hassle.

Be Consistent

Saving is like going to the gym. You can only expect something substantial by saving up to 20% of your salary for a month. However, this 20% adds up and becomes a handsome sum of money as time passes by. As a result, you need to be consistent and careful about the decisions you make. Do not break the cycle. Otherwise, you might fall out of the habit. Even if it is difficult, keep sight of the reason that compelled you to have a home budget. This will keep you motivated throughout the process.

Some General Tips For Saving Money

You do not have to go overboard to save money. In fact, even the most minor steps can actually enable you to rake up a handsome amount of cash. Here is some of the generalized advice that I follow in order to save up money:

- Thrift over brands: I prefer thrifting my clothes instead of buying branded clothes.

- Meal Preparation: eating out is a delectable idea. However, meal prep is cost-effective. Therefore, you must choose accordingly.

- Use cashback: I enjoy taking cashback on my credit card. Therefore, I suggest the same thing to everyone I meet.

The Final Thought

In summation, that is all there is to having an efficient home budget. However, let me reiterate that having a budget will not make your life easier instantaneously. It will be long before you start seeing returns. Therefore, you need to keep at it and be consistent about it to make any difference.

Read Also:

Leave A Reply