Commercial Loan Truerate Services – Benefits, Eligibility, Documents [Complete Guide]

If you have been searching for “Commercial Loan TrueRate Services” all over the internet but cannot really figure out how to apply? Or why do you need it?.

If yes, then you have found the right place. This article serves as a complete guide to all the queries that you are having regarding the Commercial Loan TrueRate Services.

So, if you want to know the details about the eligibility and the documents for this loan, keep on reading this article till the end…

First, What Is TrueRate?

If you are looking for commercial loans, you must have heard the name of TrueRate. It is one of the leading real estate market and investment platforms that are created for financing clients and their projects.

Established in the year 2020, they are the fastest-growing service organization. They provide simple and efficient portals that help clients pay off their debts faster and in a more standardized way.

In the words of Michael Rosenfeld, one of its officials, TrueRate was developed “in order to build something that was developed by very active borrowers for borrowers.”

In case you want to know more about the origin of the company, here is a short clip:

What Is A Commercial Loan?

According to Investopedia,

“A commercial loan is a debt-based funding arrangement between a business and a financial institution such as a bank. It is typically used to fund major capital expenditures and/or cover operational costs that the company may otherwise be unable to afford. Expensive upfront costs and regulatory hurdles often prevent small businesses from having direct access to bond and equity markets for financing.”

Generally, a commercial loan is a loan that a bank or a financial institution offers to a business. Businesses use this loan to fund the cost of operation. However, to avail of the loan, the business needs to keep collateral with the provider. Here, collateral might include equipment and property.

Apart from that, to avail of the loan, a company will need to provide its financial statements to prove its ability to repay the loan to the bank or the financial provider. Furthermore, most commercial loans are short-term. However, at times of need, a business can renew it to extend the life of the loan.

Commercial Loans: How Do They Work?

A bank or a financial provider grants commercial loans to a variety of business entities. Here, businesses need those loans to meet their short-term operating needs. Apart from that, businesses also need those loans to facilitate business operations. In other cases, companies also use those loans for primary purposes like to pay for payroll, or to purchase supplies for the production and manufacturing process.

Moreover, a business needs to keep collateral with the bank to get access to the loan. Here, the bank asks for collateral as security from the business in case the company becomes a defaulter on the loan.

The bank usually asks for collateral in the form of property, equipment, etc. If the borrower defaults on the loan, the bank confiscates the collateral from the borrower. Apart from that, the bank also uses the cash flows from the accounts receivable as the collateral from the loan.

However, not all small businesses will receive a commercial loan. The creditworthiness of the applicant plays a major role in deciding whether the applicant is eligible or not. Hence, in most cases, banks require applicants to present documentation. For businesses, these include balance sheets, financial reports, and other related documents.

Banks do this to ensure that the business they are providing loans to has a consistent flow of cash. Hence, this works as an assurance to lenders that the business can repay the loan.

Commercial Loan TrueRate Services: What Is That?

In order to learn about this part, you need to have a thorough understanding of what is a Commercial Loan. So what is it?.

A Commercial Loan is somewhat like a financial instrument that lets business owners avail in order to address the capital needs that are short term. There is a sanctioned amount when it comes to commercial loans. This amount can help to acquire newer machinery or for increasing the working capital.

Now coming to the Commercial Loan TrueRate Services— what are they, and how can they benefit you?.

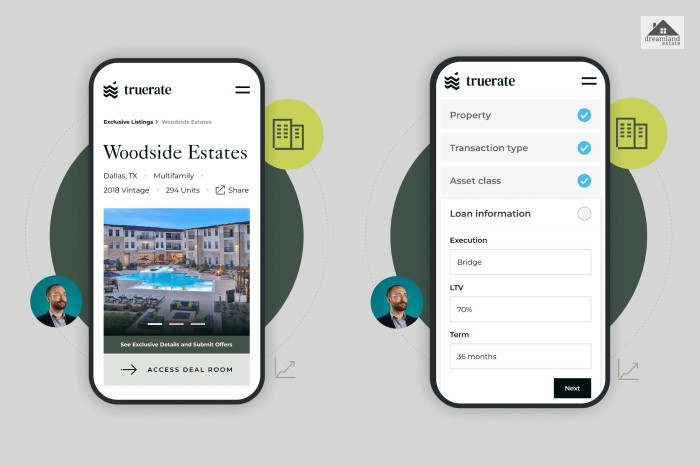

If I have to keep it simple and tell you what it is, I will say that it’s one of the best loans that the company provides you on non-residential properties. Some of the best examples of these properties are office spaces and shopping malls.

This commercial loan platform is one of the best that you can get if you have a commercial property. One of the main differences between this loan and any other loan is the fact that the right to commercial property secures it.

This means that if the loan is not repaid, a right over the property can be established or used as security. In other words, the organization TrueRate secures commercial loans for clients in the real estate industry. So in a way, it is helping both the lender as well as the debtor.

Services: What Are The Services That TrueRate Commercial Loans Provide?

While it is true that the organization helps the debtors by providing them with efficient services, it is important to know what services that TrueRate actually provides.

Here are the main services that TrueRate provides in terms of Commercial Loans:

1. Equity Placement

It is the strategy that helps you to raise capital in the market. Then, with the help of equity placement, the business is able to get a boost through the much-needed capital or funds. One of the best parts about this entire deal is the fact that the investors do not need businesses to pay back the money.

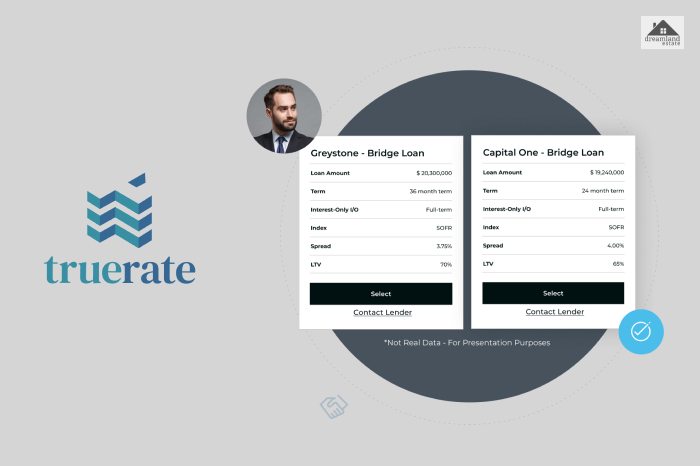

2. Debt Financing

Another important service that TrueRate provides is debt financing. It is one of the most common ways in which one can start or grow a business. The businesses can raise money with the help of the services that TrueRate provides.

In simple words, they provide capital to the businesses when in need and hence, act as a broker.

3. Investment Sales

If you are the owner, you will be able to benefit from the movements in the market of commercial real estate in real time. This will help you to determine the real value of the property or asset in the market.

Knowing the actual price or the market value of the asset will be of great help to you when you are the owner, as you will be aware of the actual conditions in the market.

Eligibility: Are You Eligible To Apply For The Loan?

In order to apply for the Commercial Loan TrueRate Services, there are certain criteria that you must fulfil.

You can apply for the loan if you have a:

- Sole-proprietorship

- Private company

- Public Company

- Limited liability company

These are some of the criteria that you need to fulfil:

| Minimum Age | 21 years |

| Maximum Age | 65 years |

| Age of Business | 5 years (minimum) |

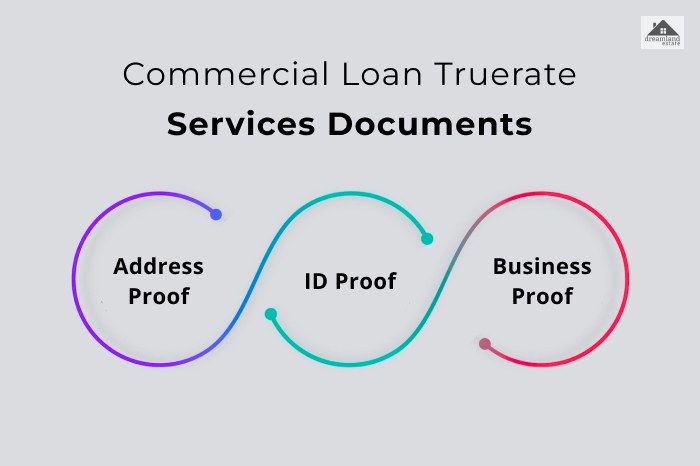

Documents: These Are What You Need!

Here is a list of documents that you need to apply for the Commercial Loan TrueRate Services:

| Address Proof | ◙ Voter ID ◙ Passport ◙ Driving License |

| ID Proof | ◙ Passport ◙ Electricity Bill ◙ Telephone Bill |

| Business Proof | ◙ Bank statement ◙ Balance sheet ◙ VAT Statement ◙ Income tax return ◙ Sole Proprietorship Statement |

Major Aspects of Commercial Loans to Consider

Basically, a commercial loan is a type of loan that a financial institution offers to a business. The business utilizes this loan for commercial purposes. The financial institution offers this loan through a debt-based funding agreement between the business entity and a leader in the financial institution.

A financial institution will not offer you a loan individually or for a personal reason. You can only receive a loan for commercial purposes for your business. These commercial loans are available from both banks and non-banking financial institutions. One example of the latter is TrueRate services.

According to the Corporate Finance Institute, “A commercial loan is a form of credit that is extended to support business activity. Examples include operating lines of credit and term loans for property, plant and equipment (PP&E). While there are a few exceptions (including commercial property owned by an individual), the overwhelming majority of commercial loans are extended to business entities like corporations and partnerships.”

However, to find the right loan option, you will need to devote a substantial amount of time to your research. Hence, it will give you a better idea of whether a particular loan is the right option for you or not. Basically, it can take months to find the right fit for your case.

Therefore, by having a better understanding of your needs and demands, you will be in a better position to apply for the right loan for your business. Furthermore, it is also important not to rush the process, as it may result in a waste of a significant amount of time and money.

How to Apply for a Commercial Loan?

The following are the steps you need to take if you want to apply for a commercial loan:

1. Determine the Type of Loan You Want for Your Business

There are different needs for a business, and based on those needs, you need to choose your loan option. Whether you need to finance a purchase, fund a startup, or need funds for day-to-day expenses, there are different loan options.

2. Check Whether You Qualify for a Particular Loan

The following are some of the major aspects that determine your eligibility for a commercial loan:

- Your Credit score

- Time in business

- Your revenue and your business’s revenue

Basically, the lender will check whether you will be able to pay off the loan within the stipulated time period or not.

3. Compare Different Lenders

You can check all the terms and details of various popular commercial loan providers. Then, check the ones that work the best for you. To do that, you need to be aware of the needs and demands of your business. Furthermore, you need to also check where the application process is hassle-free.

4. Gather All the Details and Documents

The following are the application materials that you need before you apply for a commercial loan:

- Business information (name, address, EIDs, business plan, proposals, etc.)

- Financial statements (including details of annual revenue, Profit & Loss statements, etc.)

- Details about the owners and management

- Collateral information

- Personal guarantee for the loan.

5. Apply for the Commercial Loan

Once all your items are in order, you are ready to apply for the loan you need. However, make sure you get all the necessary details from the lender. Furthermore, you can also get help from a financial advisor before you apply for a particular loan.

Frequently Asked Questions (FAQs):

Now that you’ve gone through most of the article, I hope that you have found the answer to your search. However, you still may have other questions regarding the same. For that, why don’t you try to check out some of these questions that readers frequently ask?

Ans: TureRate is one of the fastest growing businesses that deal with Real Estate. The headquarters of TrueRate is located in New York, the United States. The exact address is 780 Third Avenue, Suite 4400, New York, NY 10017, US.

Ans: Dan Gorczycki, one of the veterans in the field of real estate, is the founder of TrueRate. The main aim behind starting this business was to ensure that they are able to help both the debtor as well as the lender.

Bottom Line: Choose TrueRate Services For Commercial Loans!

TrueRate is one of the best and fastest-growing lending companies in the United States. In addition, it is one of the most popular real estate advisory firms that helps people who are interested in the field.

If you were looking for Commercial Loan TrueRate Services, I hope that you found this article to be of help. If there are any other queries related to the same, feel free to write them down in the comment section below.

Read Also:

Leave A Reply